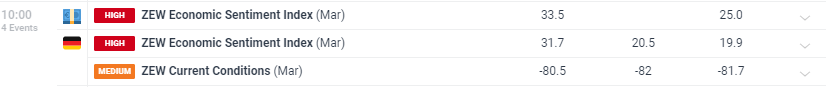

The latest ZEW Financial Market Survey showed a sharp rise in Euro Area and German economic optimism, beating market forecasts by a margin. The German number – 31.7 – was the highest reading in over two years and beat market estimates of 20.5. The Euro Area number – 33.5 – was also the highest reading since February 2022. However, the German current conditions reading remained weak and within touching distance of lows last seen in 2020.

While the improved sentiment data paints a marginally better economic picture for the EU, it won’t do a great deal in helping a currently struggling single currency. Over the next few months, both the US Federal Reserve and the European Central Bank will start cutting borrowing rates. Market expectations of US rate cuts have moved markedly over the last 3-4 months and this has propped up the US dollar. At the end of December, market probabilities suggested that the Fed would cut 175 basis points of its borrowing costs this year with the first move seen this month. The market now shows around 70 basis points of rate cuts with the first move fully priced in for the July FOMC meeting. In contrast probabilities for the ECB have grown with 86 basis points of cuts seen this year with the first 25 basis point move likely in June. Against this backdrop, EUR/USD will struggle to push higher.

EUR/USD currently trades around 1.0845 and along with a range of other currency pairs and asset classes, is waiting for the latest FED decision tomorrow. The post-announcement commentary will need to be closely noted, as will the Fed’s new ‘dot plot’ to see member’s latest interest rate forecasts.

EUR/USD has broken below recent trend support and is sitting on the 200-day sma after breaking below the 20- and 50-day smas. Next support is seen at 1.0787. The CCI indicator shows EUR/USD as neutral to slightly oversold.

EUR/USD DAILY PRICE CHART

Retail trader data shows 54.47% of traders are net-long with the ratio of traders long to short at 1.20 to 1.

The number of traders net-long is 0.56% higher than yesterday and 40.55% higher than last week, while the number of traders net-short is 1.24% higher than yesterday and 21.30% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

See how retail trade data affects a wide range of tradeable assets.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece